Nelson Bay Iron

NBR Project (Mining Lease 3M/2011) is located in the far north-west of Tasmania and is approximately 150km from the Burnie Port. The location of the Mining Lease 3M/2011 is shown in Figure 1. The Project is within an established mineral province in the region. Operating mines include Grange Resources’ (ASX: GRR) Savage River Iron Ore.

Figure 1: Location Plan – NW Tasmania

Figure 1: Location Plan – NW Tasmania

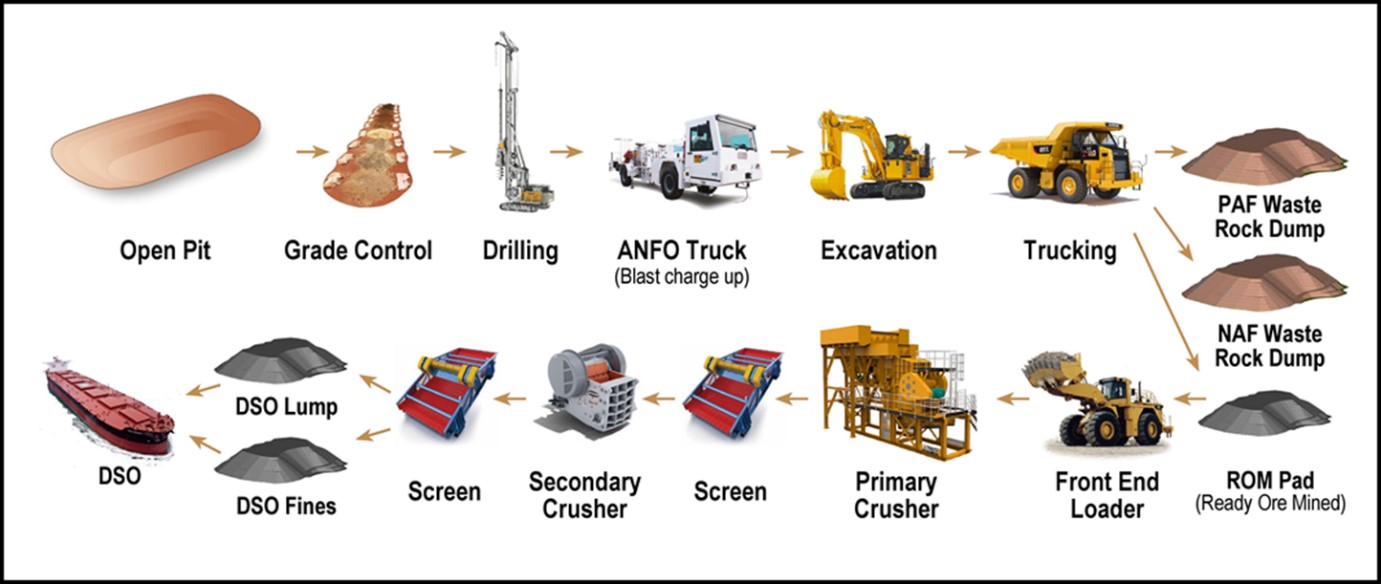

The Direct Shipping Ore (DSO) project at NBR is an all-contract mining, processing and haulage operation using local contractors in the region. It requires no major processing beyond crushing and screening after which the ore is then trucked to the port and shipped (Figure 2). It was developed in 2013 with the first shipment of ore leaving the Port of Burnie in January 2014. NBR project was placed on care and maintenance in June 2014 following sharp iron ore price falls.

Historical production from the previous mining campaign totalled 181,000 tonnes shipped with average grades of Fe 57.5%, SiO2 7.7%, Al2O3 1.3%, P 0.07% and S 0.04%. Demand from historic customers was driven by positive metallurgy, specifically low impurities like alumina (Al2O3) and phosphorus (P).

The historic price received for NBR ore was enhanced with premiums (in line with market benchmarks) for

- low Alumina; and

- (About 40% of the DSO Iron ore at NBR is Lumps with Iron ore Fines being approx. 60%)

Historic costs during FY 2014 when the mine was last in production was approximately AUD $ 72 per ton FOB Burnie Port (as derived from 2014 Annual Report to Shareholders).

Figure 2: NBR DSO Flowchart

Figure 2: NBR DSO Flowchart

With the improvement in the iron ore price, the Company has been actively working to re-permit the NBR. The strategy has been to recommence the production of the DSO resources from the existing open pit at NBR. To resolve legal issues with the existing permit, in August 2018, the Company applied for a new Tasmanian environmental permit covering the DSO operations. After public consultation, the EPA issued guidelines for the preparation of a DPEMP. Working towards adopting this framework, the Company has completed the requisite technical studies to develop the DPEMP.

Iron Ore prices while volatile, are forecast to remain at healthy levels. Any near-term supply response is expected to be limited, particularly with little latent capacity left at major Iron Ore exporting ports and railways in Australia. As Iron Ore Prices remain healthy, there has been further improvement in premiums for material with lower impurities like low alumina (like the NBR DSO product) as Chinese authorities continue emphasis on environment control.

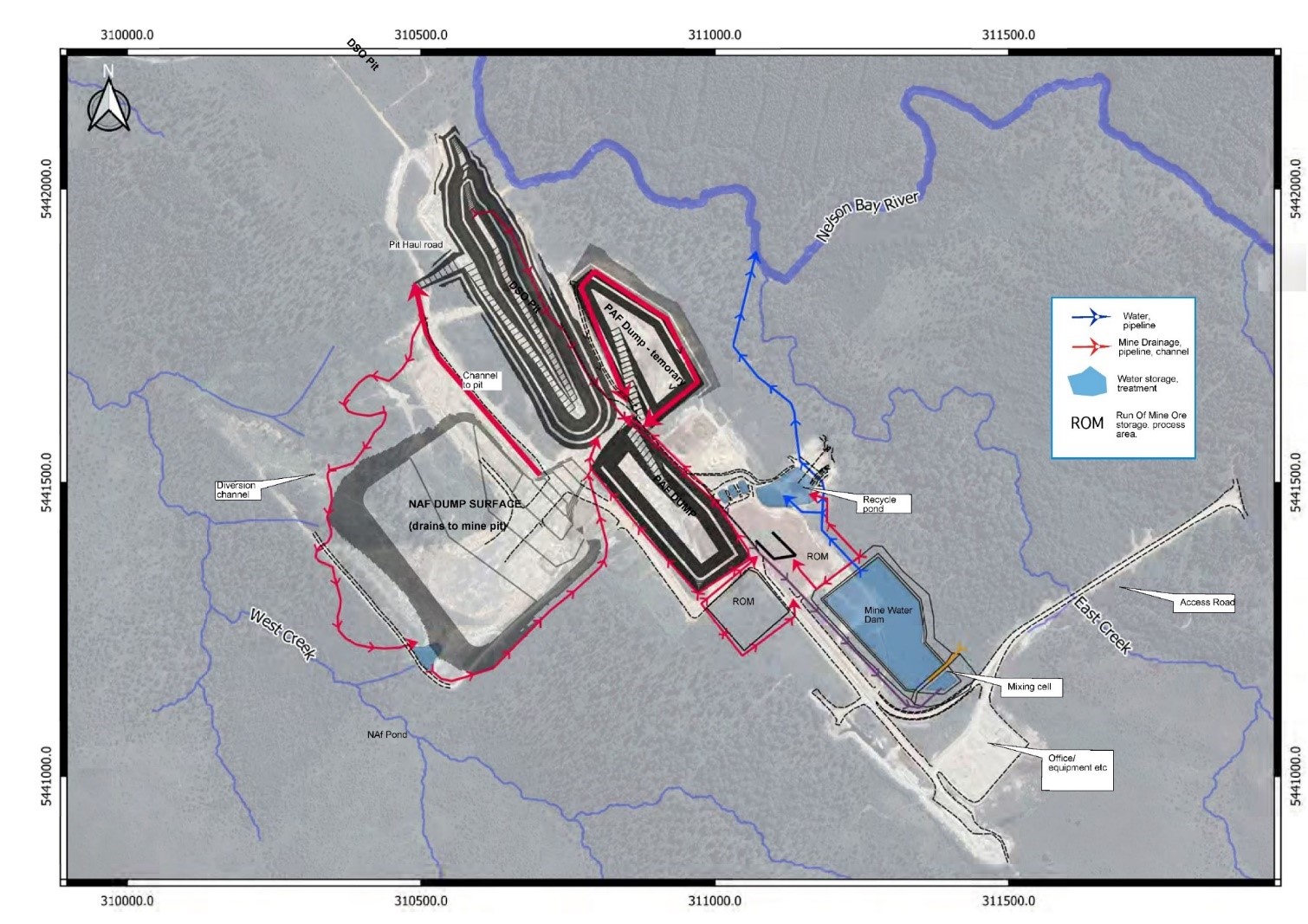

The DSO pit is some 25% complete, with waste rock materials deposited in two dumps designated as the Non-Acid Forming (“NAF”) waste rock dump and the Potentially Acid Forming (“PAF”) waste rock dump.

Figure 3 shows the existing mine development on site. The main features are the DSO pit and waste dumps. Other elements are the mine water treatment dams, ROM stockpile area and the facilities area.

Figure 4 shows the proposed development at completion of the DSO pit.

Figure 3: Existing development NBR DSO project (Source: Google Earth)

Figure 3: Existing development NBR DSO project (Source: Google Earth)

Figure 4: Proposed development NBR DSO project

Figure 4: Proposed development NBR DSO project

The next stage after completion of DSO pit will be the north pit that targets the main magnetite ore body. At the top of this pit, there is an approximate 20 metre section of higher-grade ore - the beneficial oxide resource (“BFO”). This will require only dry magnetic separation in addition to crushing and screening before shipping. The BFO operation is a transition between the DSO operation and the magnetite production stage. The BFO circuit will require only a nominal capital expenditure of circa A$1 million. The BFO section is fed by a -3mm size ore stream, which is upgraded by dry Low Intensity Magnetic Separation (“LIMS”). Test work by crushing and passing the ore over a coarse LIMS unit at 600 gauss pass produced an upgraded product with grades Fe 57.5%, SiO211.5% and Al2O3 1.55% at 82.3% mass recovery.

For the magnetite project, completed studies have mine planning for an open pit that will extract ore for processing through a local plant that will include circuits to grind, mill, magnetically separate to produce high grade magnetite concentrate for Blast Furnace Pellets (“BFP”) and Dense Media Magnetite (“DMM”). Magnetite Pellets fetch a premium to hematite iron ore as they are higher grade and allow for less energy consumption in blast furnace.

Resources

NBR has a JORC compliant global iron Mineral Resource of 11.3Mt, including goethitic-hematite Mineral Resource of 1.4Mt and Magnetite Mineral Resource of 7.8Mt. (Refer Company’s ASX announcement released on 14th October 2021)

Exploration

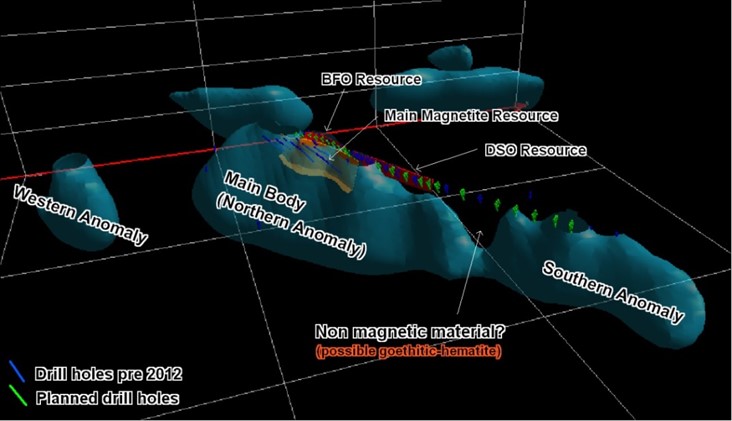

The current Resource at NBR covers approximately 1km in strike length of goethite-hematite mineralisation including approximately 400 metres of magnetite. It is based on drilling at the northern end of the strike line, where magnetic survey work indicated that the main strike line of mineralisation extends for at least 2,300 metres and is open along strike and at depth. The mineralisation in some cases is deeper than 300 metres.

A study of ground magnetics by Shree and the Tasmanian Government’s airborne magnetic survey data suggests that the strike length of iron mineralisation at NBR extends to in excess of 2.3km. Mineralisation remains open along strike and down dip and in some parts extends to greater than 300 metres in depth.

The 3D Magnetic Inversion study based on aeromagnetic data from Mineral Resources Tasmania (“MRT”) suggests continuity between the Main Body (Northern Anomaly) and the South Anomaly, but with in-between areas of non-magnetic material that could be inferred to be oxide mineralisation (Figure 5). Scattered detrital gossan fragments were noticed during recent reconnaissance in the Southern Anomaly area. The modelling indicates substantial continuation at depth of the magnetite-bearing ultramafic dyke.

This provides exploration upside for Shree. In addition to the NBR deposit, four additional targets have been identified from airborne magnetic surveys on the project area and remain to be drill tested.

Figure 5: 3D Magnetic Inversion Study (Source: SHH)

Figure 5: 3D Magnetic Inversion Study (Source: SHH)